- Customer Login

- Free Trial

- Contact Us

- Product

- Connections

- Custom Reports

- Embedded Dashboards

- Data Transformation

- Data Level Security

- Inventory Forecasting

- Historical Data and Migrations

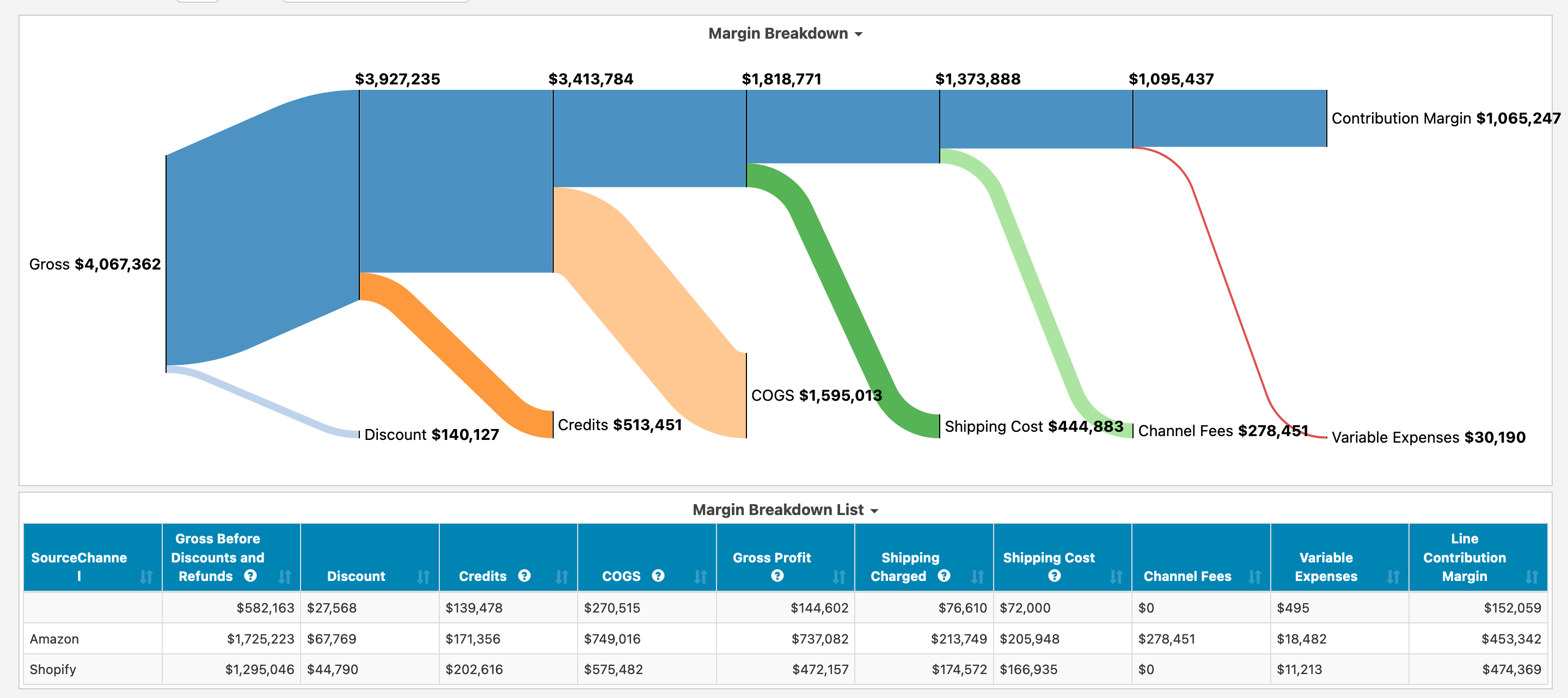

- Profit and COGS Analysis

- B2B Reporting

- All Industries

- Apparel and Footware

- Creative Agencies

- Health and Wellness

- Manufacturers and E-Commerce

- Pricing